Market Commentary: September 29th, 2009: 10:00 am (PST). Posted by Manu Walia

“Consumer confidence did not improve in September according to the Conference Board’s index that fell back to 53.1 from 54.5 (54.1 initially reported). The worse news in the report is the current assessment of the labor market with substantially more saying jobs are hard to get, 47.0 percent vs. 44.3 percent, and less saying jobs are plentiful, a miniscule 3.4 percent vs. Augusts’ 4.3 percent.”

Source: www.Bloomberg.com

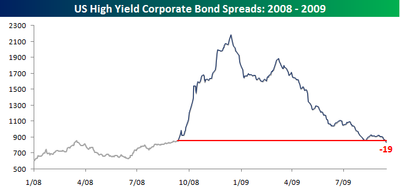

We have been monitoring important leading economic indicators to view how the markets could behave going forward. So far, as mentioned umpteen times before, most leading indicators are moving in the positive territory. Having said that, one can not and should not ignore how the markets have performed based on facts and not projections. Following is a chart of the corporate bond yield spreads relative to US treasury bonds.

Source: http://seekingalpha.com/article/161892-high-yield-spreads-fall-below-pre-lehman-levels?source=feed

Source: http://seekingalpha.com/article/161892-high-yield-spreads-fall-below-pre-lehman-levels?source=feed

The endeavor with studying the yield spreads is to understand investor perception of risk. As yield of any debt instrument is inversely related to its price, the higher the price the lower the yield. It can be observed by the chart below that investors were very fearful of the corporate high yield bonds (worried about the economic viability of an average US corporation) and favored the safety of a treasury bonds. The difference between the yield of a CCC (junk status) corporate bond and the 10 year treasury hit a high of approximately 21% in the fourth quarter of 2008. Since then the yield spread has stabilized and improved to approximately 8%, which is the level experienced pre Lehman Brothers collapse.

We infer from this spread contraction that the average investor has gravitated towards higher risk asset classes and believes that the markets are in a state of some stability. Once again, we do not believe that the capital markets can sustain the type of rally we have witnessed, especially in the debt markets going forward. We would encourage investors to harness profits in the corporate bond environment as interest rates can not go down any further. If the US economy starts to improve and inflation shows its ugly head, the government will have no choice but to raise rates. In that situation, the high yield bond market can take a significant hit.

Investor beware…

Market Commentary: September 24th, 2009: 10:00 am (PST). Posted by Manu Walia

“Layoffs are definitely easing as initial jobless claims surprised to the downside for a third week in a row, down 21,000 in the Sept. 19 week to a 530,000 level that is right at the very best end of expectations (prior week revised from 545,000).”

In addition to an improving jobless claims situation, the Federal Open Market Committee had positive comments on the position of the economy and their continued support. The cost of capital (interest rates) is at extreme low levels that bode well for businesses. Inflation, a measure of affordability for average consumer is at sub 2% levels and is expected to remain low for the foreseeable future. The price of oil is currently below $69.00 which is down from $147 over a year ago.

Despite the positive news, the markets have given up almost 120 point or approximately 1.5% over the last two days. In our view this signifies profit taking after a three week steady ascent on major indexes.

Even though the economic fundamentals seem to be improving, we should not forget that the market has a tendency to discount or factor in the future, whether its growth or contraction. As mentioned before, if the market continues to provide good news, the expectation for better news continues to increase. These conditions could be a pre cursor to a correction of 5-7% based on primarily technical reasons.

We would be very selective in choosing equities and stay away from areas that have experienced huge increase in value relative to the market. We encourage investors to be cognizant of the margin of safety for their investments. In other words, it would greatly help to attempt to evaluate the downside for individual securities in investor portfolios in case the market corrects by 5-7%. As an individual investor, if one believes that their security holdings have provided significant returns relative to the market or are in overvalued position, it would be prudent to harness profits or place a risk mitigation strategy like stop losses.

Market Commentary: September 16th, 2009: 7:30 am (PST). Posted by Manu Walia

“Ground breaking for new homes rebounded as multifamily starts came off recession lows. But single-family starts took a step back. Housing starts in August rose 1.5 percent, following a revised 0.2 percent drop the previous month. The August pace of 0.598 million units annualized was down 29.6 percent year-on-year and essentially met the market forecast for 0.600 million units. The rebound in August was led by the multifamily component which jumped 25.3 percent after plunging 15.2 percent the month before. However, the single-family component slipped 3.0 percent after rising 3.3 percent in July. Overall, however, starts have risen significantly since recession bottom. A faster pace likely would be unhealthy given the relatively moderate recovery in sales.”

Initial claims fell another 12,000 in the Sept. 12 week on top of the surprising 19,000 drop in the Labor Day week. The current level at 545,000 is 30,000 below expectations that were skeptical over the prior week’s big improvement. Improvement is proving to be no fluke with the four-week average down 8,750 to 563,000.

We have mentioned umpteen times in the past on this commentary section that unemployment is a crucial variable in the turn around of the housing scenario. Weekly jobless claims have been consistently improving and it seems like that the housing scenario is also going through a bottoming process.

Markets are resilient and have benefited from excess liquidity provided by various stimulus packages around the world. The major endeavor of these respective stimulus packages had been to unclog the banking system and allow the normal flow of capital in the system. It seems like the government has been able to accomplish that. It becomes crucial that the economy becomes fundamentally healthy so that increased business activity could pay for the debt the government has harnessed.

Under the current circumstances it may not pay to be complacent as major markets have experienced significant gains in a short period of time. Despite our projections of a short term correction at the 9,500 and 1,050 levels for the Dow Jones Industrial the S&P 500 index respectively, the markets continue to move up. We still believe that markets will experience interim corrections on its way up and would not recommend being fully invested at current levels.

Market Commentary: September 12, 2009: 12:30 am (PST). Posted by Manu Walia

“First-time jobless claims fell a substantial 26,000 in the Sept. 5 week to a lower-than-expected level of 550,000 (prior week revised from 570,000). Aside from adjustment-related volatility during the summer auto shutdowns, the latest level is the lowest since the very beginning of the year.”

“Consumer sentiment picked up nicely in the first half of the month, extending last month’s second half gain. Reuters/University of Michigan’s consumer sentiment index rose 4-1/2 points to 70.2 with gains split evenly between expectations, now at 69.2, and the assessment of current conditions, at 71.8.”

We have been focused on two main variables in the market that we believe have attributed to the direction of the markets, in addition to the abundance of liquidity in the markets. As mentioned above, these are the unemployment conditions and the consumer confidence in the US and global economic turnaround.

The markets have obviously construed stabilizing economic indicators in a stride and have helped bolster the markets significantly. Even though the OECD economic indicator index has started to improve, resulting in a build of confidence in the capital markets, we do not believe that the markets will continue their assent at the pace experienced over the last six months. An investor who has not fully participated in the market move, now faces with the dilemma of either investing at relatively elevated levels or risk the possibility of loosing out if the markets continue their assent.

Investor sentiment works in a herd mentality and currently the herd is in the bullish camp. The recent memory of the bearish phase in 2008 and first quarter of 2009 will illustrate classic investor sentiment. Investors were ready to throw in the towel and most did at lowest levels of the markets. Money markets levels at various brokerage houses reached almost $4 trillion, during first quarter 2009, an all time high, which comprised of over 35% of the total US stock and mutual fund market value. Majority of investors expected deteriorating conditions and kept divesting out of the markets. Similarly, average investors currently seem to expect continued positive chain of events going forward.

As mentioned during our August commentary, we would be cautious and harvest profits based on bottom up stock valuations and margin of safety. In other words, we recommend staying with equities that have not participated in the recent market move and taking partial profits from stocks that have skyrocketed.

DISCLAIMER:

The data and analysis contained herein are provided “as is” and without warranty of any kind, either expressed or implied. Continuum Global Asset Management LLC (CGAM), any CGAM affiliates or employees, or any third party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any CGAM publication. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. CGAM accounts that CGAM or its affiliated companies manage, or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. CGAM uses and has historically used various methods to evaluate investments which may, at times, produce contradictory recommendations with respect to the same securities. When evaluating the results of prior CGAM recommendations or CGAM performance rankings, one should also consider that CGAM may modify the methods it uses to evaluate investment opportunities from time to time, that model results do not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, that other less successful recommendations made by CGAM are not included with these model performance reports, that some model results do not reflect actual historical recommendations, and that investment models are necessarily constructed with the benefit of hindsight. For this and for many other reasons, the performance of CGAM’s past recommendations and model results are not a guarantee of future results. The securities mentioned in this document may not be eligible for sale in some states or countries, nor be suitable for all types of investors; their value and income they produce may fluctuate and/or be adversely affected by exchange rates, interest rates or other factors. All of the views expressed in CGAM research reports accurately reflect the research analyst’s personal views regarding any and all of the subject securities or issuers. No part of any analyst compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in a research report. Further distribution prohibited without prior permission. Copyright 2009 © Continuum Global Asset Management LLC. All rights reserved.