Market Commentary: December 29th, 2009: 12:00 am (PST). Posted by Manu Walia

I believe more and more that the world of investing is based on forward looking projections than actual news. The most important variable in projecting the value of a security or the economy as a whole is the earnings power of that entity. When the markets started to collapse in 2008, it was primarily due to the housing bust. The housing decline took away a lot of the disposable income US home owners were deriving from their homes. The US economy, which is primarily based on consumer spending (US consumers contribute over 70% to the US GDP), started to see declines in employment, primarily in sectors associated to housing. This ripple effect went into areas like construction materials and consumer durables like cars and home appliances. As the markets deteriorated, the worldwide investor that had invested in the US housing boom were also rattled and as a result consumption declined in those areas of the world as well.

The S&P 500 (the top 500 US companies) had a price to earnings ratio of approximately 23-24 (A visual of the history of the markets: http://cgamadvisor.com/S&P-PE-Since-1930.pdf ) in 2007 before the markets decline. In other words, most economists in 2007 were expecting the 500 companies to earn $65-70 for the following 12 months. This obviously did not happen as the markets started to correct. As unemployment started to increase and the housing sector deteriorated further, analysts started to lower the earnings projections. The markets touched a low of 672 on the S&P 500 and 6,452 on the Dow Jones Average in March 2009. The earnings estimate at that time had gone down to about $55 for the S&P 500. During this time, the price earnings ratio had gone down to about 16.5. At this time of total panic the US government intervened and flooded the market with liquidity. This was experienced throughout the globe as major economic regions followed suit. This truly helped the financial system, but more importantly it helped bring back investor confidence.

Currently, the housing markets seem to be improving in conjunction with improving employment situation. This could be buoyant for the real estate sector that could lift earnings primarily for the financial sector in the US. In addition, the US consumer has started to save more and the savings rate in the US has gone up for the first time in decades. In addition, the turmoil in 2008 compelled most corporate entities to cut cost and improve their balance sheets. Currently, the US corporate environment seems healthy, flushed with cash and ready to ramp up for a growth phase.

This all sounds rosy, but I feel a bit differently. In the short term people are focused on US growth internally. In other words, how will the US consumer maintain the level of consumption on borrowed funds (credit cards, loans, home equity lines of credit etc).Even thought this is very important for a $12-13 trillion economy, I believe that the US has a great global opportunity in the longer term. I believe that the rest of the world is experiencing a growth in their disposable income. Countries like India and China each have a middle class that is bigger than the entire population of the US. As these economies, with others like Latin America and Eastern Europe continue to grow, it provides the US with a huge market to export high value products. This could include products and services with high value add and high barriers to entry. For example, Boeing can not be replicated, at least in the short to medium term. Also, brand names like Coach, Prada and even Starbucks has an affluent appeal that the wealthier population of these areas would embrace.

On the short term, which would be the next 12 -18 months, I believe that the US economy can grow at around 2.5-3%. This rate of growth has sustained a 100% return on the Dow Jones Average every decade, over the last 50 years with the exception of early 1970 s recession and the most recent decade (Research write up on the website: http://cgamadvisor.com/Dow-26000.pdf ). If in fact, the US economy can grow at around 3%, other emerging economies will sustain their high growth rates. If this assumption is correct, then we should see the US markets move up another 10-12 % in 2010.

I have been a proponent of international companies and especially US companies with international exposure. The sectors I recommend considering, would be large international financial, technology, healthcare and materials companies.

Market Commentary: December 22nd, 2009: 10:30 am (PST). Posted by Manu Walia

“Existing home sales pivoted steeply higher in November and October in what will prove a striking feature of graphs on the housing sector. Existing home sales, showing strength across all regions, jumped 7.4 percent in November on top of October’s record 9.9 percent surge. The year-on-year rate is up 44 percent. The annual sales rate is 6.54 million split between single-family homes, at 5.77 million for a plus 42 percent year-on-year rate, and condos, at an annual 770,000 for a 60 percent gain. Strong sales and slow construction are draining supply which is at 6.5 months for the lowest rate in 3-1/2 years. Prices are leveling as the median price ended a long run of monthly declines, up 0.2 percent to $172,600. The year-on-year rate continues to improve, at minus 4.3 percent in November.” Source: www.Bloomberg.com

It can be clearly seen from the chart above that the housing dimension is showing improvement. It wasn’t long ago that the entire debacle with global capital markets revolved around the US housing markets and the problems that arose from innovative mortgage products. Recently a study by the Brookings institute illustrated and described the employments situation and it’s correlation with the housing markets. As we have mentioned umpteen times, we believe that the unemployment situation will only improve with the advent of global trade and wage competition.

Source: ThyssenKrupp AG, May 2009 Monthly Economic Report.

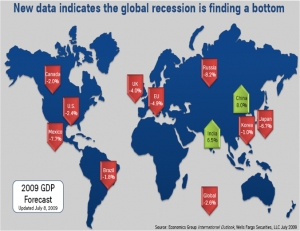

We have also enclosed a visual that clearly shows the growth areas in the world. We would encourage investors to invest in areas of the globe that are experiencing relatively higher growth like the Asian region and specifically in sustainable growth sectors like financials, materials, healthcare and technology.

In the meantime, please do your part and go to your local mall during this jolly time.

Merry X-mas.

Market Commentary: December 20th, 2009: 7:30 pm (PST). Posted by Manu Walia

In our previous market commentary dated December 6th, we had provided an analysis based on correlation of Gold and the US dollar. Our analysis showed the overbought position of the Gold vs. the dollar. Since Dec 6th, the biggest Gold exchange traded fund (GLD) has lost approximately 4.5% and the (UUP) the fund we have used as a proxy for the dollar has gained close to 2.6%. In other words, a short gold and long dollar trade would have resulted in approximately 7-8% gain in a two week span.

As mentioned umpteen times before, we believe that this phenomenon is primarily due to investor belief that the federal government will start raising rates sooner rather than later coupled with the recent weakness in economic fundamentals in countries like Greece, Italy and Ireland, part of the European Union. As the economic indicators in the US point towards a recovery, investors expect the government to turn the liquidity spigot off, which would be a major deterrent to the fervor of the recent market bullish sentiment.

A major reason for the federal government to raise rates would be the worry of inflation. We do not believe that inflation will be a real threat primarily due to the cheaper labor throughout the world. In addition, global competition would continue to catalyze innovation in the field of efficient and enhanced energy sources that will also maintain reasonable inflation levels.

We can not ignore the fact the emerging markets are growing at a much faster pace relative to developed markets and hence will continue to provide an attractive investing arena. We encourage investors to view larger companies in emerging markets which are involved in Financial, materials, agriculture and technology sector. Even though these countries will experience stronger currencies going forward, the higher domestic growth in these areas will enhance the top line.

Market Commentary: December 6th, 2009: 10:00 am (PST). Posted by Manu Walia

“Traders did not need their second cup of coffee this morning as they were jolted by a sharply better than expected jobs report for November. Payroll jobs barely moved down while the unemployment rate actually eased. Nonfarm payroll employment in November edged down only 11,000, following a revised decline of 111,000 in October and a revised decrease of 139,000 in September. October and September revisions were up 159,000 net (less worse) for the two months. As suggested by recently lower initial jobless claims, the November contraction in payroll employment was far better than the market forecast for a 100,000 decrease. Job losses in the construction, manufacturing, and information industries were offset by job gains in temporary help services and health care.”

Needless to say, the jobs report announced on December 4th was a significant improvement and a turn around in the improving situation of the US economy. Despite the positive market reaction in the early hours, the markets couldn’t sustain the initial enthusiasm and ended up with a small gain.

We as many others were intrigued with a development that happened in the US dollar and the glitzy commodity known as Gold. It seemed like the markets, even though elated to see the positive job numbers started to anticipate the Federal government’s next move in relation to interest rates. If the Federal government starts to raise rates, it would bolster the dollar hence a negative for commodities. This action caused the biggest gold fund (GLD; Exchange Traded Fund) to loose over 4%, with the highest trading volume in the last 5 years.

GLD vs UUP Dec 4 2009 (Click to Download)

Source: www.Fidelity.com

The chart above illustrates the relationship between the Gold Fund (GLD) and the US Dollar fund (UUP) we have used as a dollar proxy. It can be clearly observed that there is a negative correlation between the two. In addition, enclosed is a chart below that illustrates the divergence of the ratio of Gold to the US Dollar over the last two years. The average ratio of GLD (Gold Fund) / UUP (Dollar Fund) has been 3.74. Currently, this ratio is at 5.06, which is approximately 135% of the average. The ratio had reached a high of 5.38 on December 2nd, 2009.

GLD-UUP Ratio Dec 4 2009 (Click to Download)

Source: www.Fidelity.com

If the Federal government starts to raise rates, we would have to imagine that the economy then would be in good shape and there would be worry about inflation. Currently, we believe that inflation will be contained primarily due to wage pressures and cheap labor across the world. If our assumptions are correct, then investors should continue to move assets into riskier assets and the worry of inflation will diminish. If this happens then we should experience an exit from Gold and precious metals.

We believe that as the global markets recover, assets will continue to gravitate towards, higher quality dividend paying companies both in the US and globally. In addition, the sectors we believe will continue to show strength and rebound are: Healthcare, Financials and Technology.

Market Commentary: November 25th, 2009: 10:00 am (PST). Posted by Manu Walia

“Improvement in initial claims is picking up steam in what points to lower payroll losses for November’s employment report. First time claims fell 35,000 in the Nov. 21 week to 466,000 (prior week revised 4,000 lower). The four-week average also broke below 500,000, down 16,500 to 496,500. Continuing claims are also falling, down 190,000 to 5.423 million in data for the Nov.. 14 week, but here the change also reflects the expiration of benefits. Those receiving extended benefits fell 34,600 to 539,500. Continuing claims may be clouded but initial claims offer perhaps more reason for optimism than any other piece of economic data.”

Source: www.bloomberg.com

“Layoffs may be easing but consumer spirits remain depressed in what may be a decisive negative for holiday retail sales. Reuters/University of Michigan’s consumer sentiment index came in at 67.4 for November, up slightly from mid-month but down from 70.6 in October. Inflation expectations are benign showing 1 tenth downticks in both the 1- and 5-year outlooks.”

Source: www.bloomberg.com

Our July 9th Market commentary included the following excerpt…

“Initial jobless claims declined 16,000 to 614,000 for the week ending June 27 as reported by Bloomberg. We stated in our July Newsletter that we would be in the camp of expecting better employment numbers as we head into the second half of 2009. In addition to the unemployment situation, Alcoa (a Dow Jones index component) reported better than expected earnings and the management’s belief in improving global economic conditions.

At the end of the day, the investor and consumer population has to feel positive and reassured that we are headed in the right direction; both politically and economically. Major economic variable are pointing towards the stabilizing health of our patient known as The Economy. Do we now believe that the political doctors are doing all they can to rehabilitate this patient to improve the overall economic situation. Only time will tell…”

In other words, we believed that the second half of 2009 should do well in terms of unemployment improvement. Not only have we seen this improvement but the market has factored the turnaround by gaining approximately 27% since July 9th. Unfortunately, most analysts are starting to get positive and recommending being long in the market.

Even though we believe in the long term sustenance of this bull market (primarily globalization and emergence of the BRIC {Brazil, Russia, India and China} like countries) we would not be surprised if the markets corrected 5-7% over the near future. As we come to the end of the fiscal year, the mere window dressing by major financial institutions that include mutual funds creates turbulence in the markets. We would therefore caution investors and encourage them to either add to their position or take fresh positions during market pull backs.

Happy Thanks Giving…

PLEASE REVIEW MARKET COMMENTARY ARCHIVED ON A MONTHLY BASIS

DISCLAIMER:

The data and analysis contained herein are provided “as is” and without warranty of any kind, either expressed or implied. Continuum Global Asset Management LLC (CGAM), any CGAM affiliates or employees, or any third party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any CGAM publication. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. CGAM accounts that CGAM or its affiliated companies manage, or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. CGAM uses and has historically used various methods to evaluate investments which may, at times, produce contradictory recommendations with respect to the same securities. When evaluating the results of prior CGAM recommendations or CGAM performance rankings, one should also consider that CGAM may modify the methods it uses to evaluate investment opportunities from time to time, that model results do not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, that other less successful recommendations made by CGAM are not included with these model performance reports, that some model results do not reflect actual historical recommendations, and that investment models are necessarily constructed with the benefit of hindsight. For this and for many other reasons, the performance of CGAM’s past recommendations and model results are not a guarantee of future results. The securities mentioned in this document may not be eligible for sale in some states or countries, nor be suitable for all types of investors; their value and income they produce may fluctuate and/or be adversely affected by exchange rates, interest rates or other factors. All of the views expressed in CGAM research reports accurately reflect the research analyst’s personal views regarding any and all of the subject securities or issuers. No part of any analyst compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in a research report. Further distribution prohibited without prior permission. Copyright 2009 © Continuum Global Asset Management LLC. All rights reserved.