Market Commentary: November 25th, 2009: 10:00 am (PST). Posted by Manu Walia

“Improvement in initial claims is picking up steam in what points to lower payroll losses for November’s employment report. First time claims fell 35,000 in the Nov. 21 week to 466,000 (prior week revised 4,000 lower). The four-week average also broke below 500,000, down 16,500 to 496,500. Continuing claims are also falling, down 190,000 to 5.423 million in data for the Nov.. 14 week, but here the change also reflects the expiration of benefits. Those receiving extended benefits fell 34,600 to 539,500. Continuing claims may be clouded but initial claims offer perhaps more reason for optimism than any other piece of economic data.”

Source: www.bloomberg.com

“Layoffs may be easing but consumer spirits remain depressed in what may be a decisive negative for holiday retail sales. Reuters/University of Michigan’s consumer sentiment index came in at 67.4 for November, up slightly from mid-month but down from 70.6 in October. Inflation expectations are benign showing 1 tenth downticks in both the 1- and 5-year outlooks.”

Source: www.bloomberg.com

Our July 9th Market commentary included the following excerpt…

“Initial jobless claims declined 16,000 to 614,000 for the week ending June 27 as reported by Bloomberg. We stated in our July Newsletter that we would be in the camp of expecting better employment numbers as we head into the second half of 2009. In addition to the unemployment situation, Alcoa (a Dow Jones index component) reported better than expected earnings and the management’s belief in improving global economic conditions.

At the end of the day, the investor and consumer population has to feel positive and reassured that we are headed in the right direction; both politically and economically. Major economic variable are pointing towards the stabilizing health of our patient known as The Economy. Do we now believe that the political doctors are doing all they can to rehabilitate this patient to improve the overall economic situation. Only time will tell…”

In other words, we believed that the second half of 2009 should do well in terms of unemployment improvement. Not only have we seen this improvement but the market has factored the turnaround by gaining approximately 27% since July 9th. Unfortunately, most analysts are starting to get positive and recommending being long in the market.

Even though we believe in the long term sustenance of this bull market (primarily globalization and emergence of the BRIC {Brazil, Russia, India and China} like countries) we would not be surprised if the markets corrected 5-7% over the near future. As we come to the end of the fiscal year, the mere window dressing by major financial institutions that include mutual funds creates turbulence in the markets. We would therefore caution investors and encourage them to either add to their position or take fresh positions during market pull backs.

Happy Thanks Giving…

Market Commentary: November 24th, 2009: 9:30 am (PST). Posted by Manu Walia

“Initial jobless claims didn’t break through 500,000 but the report is still favorable. Initial claims were unchanged in the Nov. 14 week at 505,000 (prior week revised 3,000 higher). The four-week average fell 6,500 to 514,000, down for a convincing 11th straight week.” (Nov 19th)

Source: www.bloomberg.com

“GDP for the third quarter in the advance estimate came in stronger than expected with a 3.5 percent gain, following a 0.7 percent dip in the prior quarter. The third quarter boost was the first positive GDP number since a 1.5 percent increase for the second quarter of 2008.”(Nov 24th).”

Source: www.bloomberg.com

“The outlook for the housing sector is turning higher. Existing home sales came in at a much higher-than-expected annual rate of 6.10 million, up a record 10.1 percent in October (September revised slightly lower to 5.54 million). The year-on-year rate, at plus 23.5 percent, is also a record (series begins in 1999).”

Source: www.bloomberg.com

Mentioned above are three very positive economic indicators. GDP seems to have turned around, housing seems to be bottoming and the jobless situation, which is a lagging indicator, will also hopefully turn around within the next 2 quarters.

Economists on the other side of the equation believe that this growth is a short term result of government stimuli, which includes cash for clunkers, first time home buyer credit etc. We do believe that there is pertinence to this argument. Also, the government can not continue to subsidize consumer buying and expect it to be a sustainable phenomenon.

On the other hand, one aspect that we have not heard is how the stimulus impacts consumer sentiment going forward. For examples, a new auto purchase or home purchase with a reasonable down payment places a vested interest of the buyer in that respective purchase. As the buyer has a vested interest in the purchase, they are now compelled to sustain the payment plan and hence increase the overall financial responsibility. In other words, an owner with a vested interest in a liability will have a higher probability to fulfill his/her obligations.

We therefore believe that the government stimulus packages do have some positive attached to them which may not be measured quantitatively but qualitatively.

Market Commentary: November 18th, 2009: 9:00 am (PST). Posted by Manu Walia

Is it in our nature to continuously debate and predict the direction of the markets? Whether capital markets have already factored in the economic growth or if the growth is actually going to continue to fuel the ascent of major indexes? Despite the fact that we can not accurately predict the direction of the market, umpteen numbers of professionals make a living at it.

The major debate revolves around whether the US economy can continue to grow and bolster corporate earnings. As we all know, the US consumer comprises of over 70% of the GDP. If the consumer can not maintain its buying habits, the economy can not continue to grow. On the other hand, the average US Corporation has been on a cost cutting expedition that has brought fruition in the shape of earnings gain, despite lower revenue growth.

We believe that investors take the perception, and I repeat the perception of economic fundamentals, project them onto respective sectors and in essence specific companies and project an anticipated value. As long as the earnings guidance, once again the earnings guidance from the highly intelligent analysts (oxymoron) is facing north, the markets will experience inflows of assets and bolster the gains in the broader markets. It doesn’t hurt that governments all over the world have attempted to flood the markets with liquidity to postpone the inevitable. The saving grace is the emergence of a middle class in regions like Latin America, Asia and Europe that should provide another consumption source over the next decade or so.

Therefore, we believe that markets can overshoot on the upside as they did on the downside in 2008 and early 2009. In addition, we believe that majority of us are optimists by nature and hence compel ourselves to believe in the positive scenario as opposed to the hard truths. Once again, we believe that major growth will be experienced in emerging markets with a high historical savings rate and current domestic consumption.

Market Commentary: November 12th, 2009: 9:00 am (PST). Posted by Manu Walia

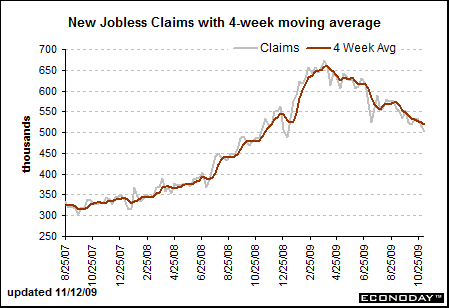

“Jobless claims continue to come down. Initial claims fell 12,000 in the Nov. 7 week to a level of 502,000 (prior week revised 2,000 higher to 514,000). The four-week average shows the progress that’s underway, down 4,500 to 519,750 for the lowest level since last November. Continuing claims extended their long downward trend, falling a very large 139,000 to 5.631 million (Oct. 31 week). Though some of this improvement may reflect new hiring, much of it unfortunately reflects the expiration of benefits.”

Source: www.bloomberg.com

Even though the jobless claims have started to stabilize, the country is not completely out of the unemployment negative spiral. We still believe that unemployment status will recover as the financial system continues to heal. We also believe that the cost savings by the US enterprise will help contain inflation for an extended period of time. In addition, higher productivity will start to diminish which should fuel hiring and help alleviate the high levels of unemployment.

We believe that the most important aspect of the US economy for long term sustainability will be the ability to export to burgeoning economies like China, India, Brazil etc. Obviously, this phenomenon will not occur overnight. But in our view, if the US can truly take medium term pain to be competitive with major emerging economies, it will experience an entire region of new consumers that could drive the US to new heights. We have mentioned previously that the US could be the next Japan, from being a net consumption society to a net production society.

Market Commentary: November 6th, 2009: 12:30 pm (PST). Posted by Manu Walia

“The jobs picture in October worsened as the unemployment rate topped double digits and payroll jobs fell more than expected. Nonfarm payroll employment in October declined 190,000, following a revised decrease of 219,000 in September and a revised contraction of 154,000 in August. The October fall in payroll employment was more negative than the market projection for a 175,000 decrease. September and August revisions were up 91,000 net for the two months (the net declines were smaller).”

Source: www.bloomberg.com

The unemployment rate has now breached the 10% level. Even though unemployment is a lagging indicator, investors can not ignore its importance as the US economy depends upon customer spending. Higher unemployment means lower disposable income and hence a deterrent to economic growth.

We have provided a chart below that looks at the unemployment levels in the US since 1940s. The chart also provides a comparison of the movement of stock prices to that of unemployment rates. It can be clearly observed that there is an inverse relationship between the two variables. We further analyzed the movement of these variables and found out that the unemployment rate was the highest in the mid 1980 s, which was comparable to current levels of over 10%. The Dow Jones Industrial index lost 15-17% from its high during 1985. Also, the Dow Jones lost approximately 45% from the high of 1972 to the end of 1975, a period that experienced over 9% unemployment. The subsequent rallies in both instances took the index to new heights in less than a year’s time horizon.

Source: www.dshort.com

Our opinion is that improving capital markets will instill confidence in consumers, increasing spending, which in turn could be a self fulfilling prophesy. We also believe that high productivity which has been propelled by high wage competition from emerging countries, will keep a lid on inflation for the time being. As the economy recovers, employment will start to pick up in areas like the financial sector and the housing arena, which faced disaster over the last two years. Based on the above mentioned improving conditions we believe that markets provide great opportunity for investors with 12-18 month horizon.

Market Commentary: November 5th, 2009: 8:00 am (PST). Posted by Manu Walia

“The jobs market may be weak and confidence in the economy is low — but consumers are spending. Chain stores reported mostly strong results in October, not uniformly strong but strong enough to indicate gains for the ex-auto ex-gas category in the monthly retail sales report from the Commerce Department.”

“Initial jobless claims are clearly on the decline, down 20,000 in the Oct. 31 week to 512,000 (prior week revised 2,000 higher to 532,000). The four-week average is down for the ninth straight week, 3,000 lower at 523,750 for a 25,000 decrease from late September. Continuing claims are also declining but here the change is likely a negative, due largely to the expiration of benefits. Continuing claims, in data for the Oct. 24 week, fell 68,000 to 5.886 million for the seventh decline in a row.”

Source: www.bloomberg.com

“Recession induced labor cost cutting has continued into the recovery and businesses are seeing gains in productivity as a result. Nonfarm business productivity in the third quarter surged 9.5 percent annualized, following a revised 6.9 percent boost in the second quarter.”

Source: www.bloomberg.com

One of the major worries on Wall Street and Main Street has been the unemployment situation since the first quarter of 2008. Fortunately, the non farm claims have been on the decline since March 2009 and as you can observe from the chart above, the trend continues. Last week we received information that the US GDP for the third quarter increased at a healthy rate of over 3.5%. If this trend continues, we can see investor confidence continue to increase and more money flowing into the capital markets.

We reiterate that investors should start considering sectors that have not already participated in the markets gains since the lows of March 2009. The major sector that should benefit from global growth is the healthcare sector in our view. In addition, earnings growth should be healthy in the financial and materials sector.

Despite the improving economic conditions, we encourage investors to invest during market pullbacks. We have emphasized this phenomenon in our November Newsletter and urge you to review it (posted in the Newsletter section).

Market Commentary: November 2nd, 2009: 9 am (PST). Posted by Manu Walia

“Coincident and lagging indicators, not leading indicators, gave a big lift to the ISM’s manufacturing index which jumped more than 3 points in October to 55.7. Employment, a lagging indicator, was a standout, at 53.1 for a nearly 7 point gain to indicate, at a plus 50 reading, that manufacturers actually added to payrolls in the month.”

“Construction spending was sharply higher than expected for September but a large downward revision to August was essentially offsetting. Overall construction spending advanced 0.8 percent in September after slipping a downwardly revised 0.1 percent in August. The increase in September was well above the consensus forecast for a 0.2 percent dip.”

“Pending home sales shot 6.1 percent higher in September to an index level of 110.1. The gain, which follows a 6.4 percent surge in August, lifts the year-on-year rate from just over 10 percent to just over 20 percent at 21.2 percent. September’s gains were centered in the West with the Northeast showing a slight decline.” Source: www.bloomberg.com

Chart 1

Source: www.bigcharts.com

Without harping on the positive news based on the economic indicators mentioned above, we would like to focus your attention on the recent rally and the interim corrections along the way. It can be clearly observed in the Chart 1 above that there have been approximately four to five corrections since the low of March 9th, in the order of 3-7%.

We believe that the market has experienced a generational low and a very traumatic experience that have thwarted a lot of investors out of the market, if not permanently, for a long period of time. On the same token, this is an opportunity for a long term investor with a positive outlook not only on the US markets but the global markets to invest in basic areas of growth. One does not have to be creative but to focus on areas that will have growth based on increasing disposable income across the emerging world. We believe that investments in healthcare, basic materials like commodities and agriculture and the financial industry would do well over the short and the long term.

Market Commentary: October 29th, 2009: 10 am (PST). Posted by Manu Walia

“Today’s moderate increase for third quarter GDP should provide some psychological lift for consumers and businesses since it is the first positive growth for the overall economy in just over a year. And financial markets are likely to like it since it is all about expectations and the advance estimate topped expectations. Real GDP in the third quarter rebounded an annualized 3.5 percent, after declining by only 0.7 percent in the second quarter. The third quarter boost came in above the market consensus for a 3.0 percent increase.”

Source: www.bloomberg.com

“Jobless claims are not offering a clear indication of what to expect for the October employment report. Initial claims held steady for a fourth straight week, edging 1,000 lower to 530,000 in an Oct. 24 week that was not skewed by special factors. The four-week average is at 526,250 and does show improvement, down about 20,000 vs. this time last month. Continuing claims, where the latest data is for the Oct. 17 week, fell substantially, down 148,000 to 5.797 million and, for the first time since April, bringing the four-week average below 6 million at 5.961 million.”

Source: www.bllomberg.com

As mentioned in our previous commentary this month, we believe that the economy is improving despite the naysayers and bearish economists. It is also true that the economic is primarily driven by the stimulus packages provided by the government which in turn is funded by tax payers.

There are two ways to consider this phenomenon; one, we can criticize the government of using tax payer funds carelessly for lost causes like the troubled banking system, or two viewing this as a community coming together to help put out a fire on a burning house so that they can save the rest of the community. As mentioned many times before, the endeavor is to support and improve the debilitated enterprise arena and create jobs in the process. This in turn is expected to provide the revenue in shape of taxes that should help diminish the growing federal deficit.

Whether this happens or not is yet to be seen. I do believe that the government should put some controls in place with an emphasis to deleverage major banking and financial institutions with the same phenomenon to follow for individual consumer. The US consumption relies to a great extent on borrowed funds. We as a nation have gravitated away from having tangible products and services to back our insatiable consumption. In other words, plastic can only last so long to pay for our needs. At some point our debt will surpass our earning power and we shall not be able to service that debt. That is why it is important to instill an attitude to spend within our means and not continue to expect our assets (real estate, equities and bonds) to continue to inflate endlessly and pay for our endless wants and desires.

PLEASE REVIEW MARKET COMMENTARY ARCHIVED ON A MONTHLY BASIS

DISCLAIMER:

The data and analysis contained herein are provided “as is” and without warranty of any kind, either expressed or implied. Continuum Global Asset Management LLC (CGAM), any CGAM affiliates or employees, or any third party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any CGAM publication. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. CGAM accounts that CGAM or its affiliated companies manage, or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. CGAM uses and has historically used various methods to evaluate investments which may, at times, produce contradictory recommendations with respect to the same securities. When evaluating the results of prior CGAM recommendations or CGAM performance rankings, one should also consider that CGAM may modify the methods it uses to evaluate investment opportunities from time to time, that model results do not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, that other less successful recommendations made by CGAM are not included with these model performance reports, that some model results do not reflect actual historical recommendations, and that investment models are necessarily constructed with the benefit of hindsight. For this and for many other reasons, the performance of CGAM’s past recommendations and model results are not a guarantee of future results. The securities mentioned in this document may not be eligible for sale in some states or countries, nor be suitable for all types of investors; their value and income they produce may fluctuate and/or be adversely affected by exchange rates, interest rates or other factors. All of the views expressed in CGAM research reports accurately reflect the research analyst’s personal views regarding any and all of the subject securities or issuers. No part of any analyst compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in a research report. Further distribution prohibited without prior permission. Copyright 2009 © Continuum Global Asset Management LLC. All rights reserved.